I know you're probably reeling from the flurry of punches from Wall Street this week. Time to brace yourselves for the knockout punch. This is the upshot of that grand plan being forced through Congress to Save Wall Street:

Here is the current draft for the latest plan. It's elegantly simple. The three key provisions: (1) The Treasury Secretary is authorized to buy up to $700 billion of any mortgage-related assets (so he can just transfer that amount to any corporations in exchange for their worthless or severely crippled "assets") [Sec. 6]; (2) The ceiling on the national debt is raised to $11.3 trillion to accommodate this scheme [Sec. 10]; and (3) best of all: "Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency" [Sec. 8].Go read the whole article. Glenn Greenwald compares it elegantly and chillingly to the naked fearmongering and power-grabs after September 11th and when Bush wanted to get his warrantless wiretapping pushed through. They're doing the same thing with finance that they did with national security.Put another way, this authorizes Hank Paulson to transfer $700 billion of taxpayer money to private industry in his sole discretion, and nobody has the right or ability to review or challenge any decision he makes.

Time to get on the phone with your representative and have a chat about adding some safeguards. After all, it's your money they want to use to bail out the gamblers.

Ian Welsh at Firedoglake breaks it down thusly:

I've pasted the text of the bill below the jump. Everyone should read it. But here are the key points:

- No one who foresaw the crisis, such as Krugman or Stiglitz, is involved in making the plan to fix it.

- The man overseeing the bailout is the ex-CEO of Goldman Sachs, a Wall Street Company. He helped cause the crisis.

- Paulson helped obtain the SEC exemption which allowed brokerages to increase leverage to 60:1 from 12:1.

- The money is Paulson's to use for buying commercial and residential mortgages and mortgaged backed securities as he chooses. No one has any oversight over him, and he can pay any price he wants to, including face amount of the debt.

- Courts cannot review his decisions, not can any regulators. He has to report to Congress once every six months.

- He gets 700 Billion dollars to use as he sees fit, looking after the taxpayer is a "consideration" not a requirement.

- Bet on that 700 Billion dollars being gone before January 20, 2009. Bet on Treasury asking for more.

- That is $2,324 dollars per man, woman and child in America

- There is no bailout for mortgage holders. Banks get bailed out, but not ordinary people.

- Banks and brokerages made record profits these last eight years. Ordinary Americans barely broke even.

- In 2007 Wall Street paid itself bonuses equal to the raises of 80 million Americans.

- Banks bailed out by this plan need make no changes in how they do business.

- Banks bailed out need not replace the management which drove them into insolvency.

- Shareholders and bondholders of such banks do not lose a cent.

- The securities which caused this crisis are still allowed.

- Expect the 700 billion dollars to increase inflation, especially in oil.

- Bush is asking you to trust his administration with 700 billion after spending 580 billion on the Iraq war. Do you trust him?

Fuck. No.

Naomi Klein, author of The Shock Doctrine, said it best when she kicked Andrew "Blame the Borrowers!" Sullivan square in his doughy little arse:

Klein: The disaster is far from over. They’ve actually just relocated. The disaster was on Wall Street and they have moved the disaster to Main Street by accepting those debts and you said they didn’t have to bomb, the bomb has yet to detonate. The bomb is the debt that has now been transferred to the taxpayers so it detonates when, if John McCain becomes president in the midst of an economic crisis and says look we’re in trouble, we have a disaster on our hands, we have to privatize social security, we can’t afford health care, we can’t afford food stamps, we need more deregulation, more privatization. The thesis of the Shock Doctrine is you need a disaster to rationalize these very unpopular policies so the real disaster has yet to come.The real disaster is the debt that is going to explode on the American taxpayers. And then they do economic shock therapy.This is exactly what they're trying to do by bailing out these lenders at the expense of the taxpayers. They're either setting it up for a convenient disaster if McCain's elected - in which case, Naomi's scenario comes into play to give the cons everything they've ever wanted - or they've just handed Obama an unmitigated disaster they'll then spend the next four years blaming him for, thus ensuring their return to power.

Let's not let them get away with it this time. Contact your congresscritter. Contact your senator. Let them know we expect spine. We need to stabilize Wall Street, but not by giving the criminals who got us into this fiasco a free pass, letting them keep all of their ill-gotten gains while turning people like you and me into the victims who have to pay for their crimes. There are ways of achieving the goal of avoiding a complete marketplace meltdown while still ensuring ordinary people are protected and the greedy fuckers responsible get their just desserts.

Now, let's talk about the unmitigated disaster that is John McCain.

Here's where he stands on health care:

His dumbfuckery doesn't stop there. This is where he stands on Social Security:The McCain campaign probably never even saw it coming. Contingencies, the magazine of the American Academy of Actuaries, published an article by John McCain, titled, "Better Health Care at Lower Cost for Every American" (pdf). As far as the McCain campaign was concerned, few would actually see the piece, and the likelihood of it having a serious impact on the campaign was negligible.

Oops.

Paul Krugman got a heads-up on this jaw-dropper from McCain's article: "Opening up the health insurance market to more vigorous nationwide competition, as we have done over the last decade in banking, would provide more choices of innovative products less burdened by the worst excesses of state-based regulation."

Remember, this doesn't reflect McCain's thinking from previous years -- the article was published in the current, Sept/Oct issue of the magazine. McCain believed, very recently, that the key to "better" care at "lower" costs was to make the healthcare industry look more like the financial industry.

From the AP:

"Wall Street turmoil left John McCain scrambling to explain why the fundamentals of the U.S. economy remained strong. It also left him defending his support for privately investing Social Security money in the same markets that had tanked earlier in the week.The Republican presidential nominee says all options must be considered to stave off insolvency for the government insurance and retirement program, and top McCain advisers say that includes so-called personal retirement accounts like those President Bush pushed in 2005 but abandoned in the face of congressional opposition."

I'll bet he's scrambling. I can't imagine anyone would accept the idea of investing their Social Security pension in the stock market with equanimity right now.

[snip]

Besides that, "top McCain advisors" are repeating another complete myth: that personal retirement accounts are a way to "stave off insolvency" for Social Security. If political journalists knew more about policy, McCain's "top policy advisors" might not have been able to complete the interview, because the reporters would have been laughing too hard. A statement like "all options must be considered to stave off insolvency for the government insurance and retirement program, and (...) that includes so-called personal retirement accounts" is, in fact, on a par with saying something like: "all options must be considered for making people healthier, including encouraging them to start smoking, operate chain saws while drunk, and take long, luxurious baths with their electric appliances."

It really is exactly that dumb.

Hilzoy's piece includes some simple stick-figure illustrations that could prove a boon to you in discussions with the terminally hard-of-thinking. According to recent polls, that's about 45% of the country right now.

Just in case you run into the demented few who swallow McCain's "Aw, Shucks, I Wouldn't Do That!" pandering - yes, he would. Even now.

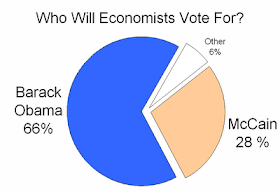

You can show them this simple picture to explain why Obama is a better choice than McCain in this economic climate:

Oh, and McCain, after cheerleading bailouts for a few days, has decided he's bored now and would like the Fed to stop doing its job:

Since before 1844 central banks have been in the business of managing financial crises. That's what they do. Milton Friedman is spinning in his grave. The prevention of large-scale bank failures--"bailouts," in McCain's terms--is an essential part of responsibly managing the money supply.

John McCain does not know that. And nobody working for John McCain knows that:

John McCain: Finally, the Federal Reserve should get back to its core business of responsibly managing our money supply and inflation. It needs to get out of the business of bailouts. The Fed needs to return to protecting the purchasing power of the dollar. A strong dollar will reduce energy and food prices. It will stimulate sustainable economic growth and get this economy moving again...

After deciding that he should be allowed to destroy your healthcare, your retirement, and our economy, McCain has also decided to take $84 million of our dollars to finance his presidential campaign. Obama hasn't. Just thought you might like to know that, and keep it in mind the next time Johnny comes by with his hand out, looking for cash.

Tell him to go play the stock market. One of the presidential candidates seems to think it's the answer to everything.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.