I've been following this for a while, and it's encouraging news if the commodities regulators follow through. These guys have been driving up the cost of oil with the same sort of shady tactics used in the financial markets. Good for the Obama administration if they take this aggressive approach:

WASHINGTON — Reacting to the violent swings in oil prices in recent months, federal regulators announced on Tuesday that they were considering new restrictions on “speculative” traders in markets for oil, natural gas and other energy products.

The move is a big departure from the hands-off approach to market regulation of the last two decades. It also highlights a broader shift toward tougher government oversight under President Obama.

[snip]In the case of oil and gas trading, regulators made it clear that they were willing to move, without waiting for Congress to act on Mr. Obama’s overhaul, invoking their existing powers.

17 December, 2009

Bleach. I Need Bleach.

John McCain is actually doing something I approve of.

He and my own dear Senator Maria Cantwell are trying to bring back Glass-Steagall.

I don't know how long this momentary lapse of insanity will last, but hopefully it'll be long enough to actually pass this shit. But you know John. He'll probably be against his own bill inside of a week.

Now, if you'll excuse me, I'm going to go soak myself in Clorox.

16 December, 2009

Libertarian Slays "Hidden Tax" Argument

Well, yes. They're called Cons. Just because they don't make direct arguments for repealing child labor laws doesn't mean they wouldn't do it in a heartbeat in the name of the "free market."

How many times have you heard the claim that some government regulation -- say, the cap and trade bill -- is really just a "hidden tax" because it will increase the cost of production for a company and therefore we'll pay more for their products? Sometimes it's stated without it being a tax, just that given policy X is bad because it will increase the cost of doing business and cause goods to cost more.

And of course, no one really wants to pay more for a product, right? But it seems to me that this argument, by itself, is pretty meaningless because it is equally true of government regulations that we all support. Forbidding factories from using child labor increases the cost of doing business and drives up the price of what is being produced; would anyone like to repeal those laws and allow child labor again?

But Ed's clever in using this argument, as it's one they can't get away with baldly refuting. There is a moral. And more ammunition. Go enjoy.

12 December, 2009

Fun With Regulatory Reform

I love the smell of reform in the morning!The 1,279-page bill creates a new federal agency dedicated to consumer protection, establishes a council of regulators to police the financial landscape for systemic risks, initiates oversight of the vast derivatives market and gives the government power to wind down large, troubled firms whose collapse could endanger the entire financial system. The legislation also gives shareholders an advisory say on executive compensation, increases transparency of credit ratings agencies and sets aside billions in government funds to aid unemployed homeowners.

Do not miss Rep. Gutierrez spanking Cons on the House floor:

As part of regulatory reform for the financial industry, Republicans believe Democrats have created a "bailout fund." Rep. Luis Gutierrez (D-Ill.) yesterday decided this is a lie worth debunking in detail.

Gutierrez, who is bilingual, told his colleagues, "I've had the bill thoroughly examined by those who do speak the English language and have only spoken the English language all their life, and they cannot find the 'bailout fund' in the bill."

Ryan Grim added, "What the bill does do, [Gutierrez] explained, is create a fund that major firms must pay into. If banks get into trouble, the fund is used to take them over, break them up and sell off the parts. If such a fund was socialist, Gutierrez said, then so is Geico. But unlike Geico, he said, drivers who crash the economy don't get their bank repaired and returned to them under the Democratic plan."

In the hopes of making this easy enough for his GOP colleagues to understand, Gutierrez explained, "What they won't tell you is unlike everybody in this room who has to go and take out an insurance policy to drive a car, they want Wall Street and Goldman Sachs to be able to drive our economy into the ground without paying a cent of insurance in case they act recklessly. And all we're saying as Democrats is: 'It's simple. If you want to do business in America and you threaten the economic stability of our country, then you've got to pay into an insurance fund.'

We'll see if that was simple enough for Cons to grasp. I somehow doubt it - he didn't bust out the crayons and construction paper.

And as the cherry on top, Rep. DeFazio and like-minded Dems are trying to get Glass-Steagall back up and running. If you don't know why that's such a good thing, why, visit the link and rejoice.

Dear Wall Street: Ha ha ha fuck you. Sincerely, Dana Hunter.

05 December, 2009

Middle Class Also Too Big To Fail

03 December, 2009

The Solution to Your Mortgage Woes: Walk Away

Sounds insane, but if the Treasury's latest bit of pressure on the banks doesn't work, and they won't modify your mortgage, you might want to consider just telling them to fuck off.

Seriously:

I've been saying this all along to people: The only real obstacles are in your head. There's no reason in the world to keep throwing good money after bad.Read up on the pros and cons, get some expert advice, and then make the decision that's in your best interests. You don't owe the fuckers who fucked our economy over a damned thing. They brought us to our knees: perhaps it's time to return the favor.

And he's right. Banks won't negotiate with borrowers until more people start to do this:

Go ahead. Break the chains. Stop paying on your mortgage if you owe more than the house is worth. And most important: Don't feel guilty about it. Don't think you're doing something morally wrong.

That's the incendiary core message of a new academic paper by Brent T. White, a University of Arizona law school professor, titled "Underwater and Not Walking Away: Shame, Fear and the Social Management of the Housing Crisis."

White argues that far more of the estimated 15 million American homeowners who are underwater on their mortgages should stiff their lenders and take a hike.

Doing so, he suggests, could save some of them hundreds of thousands of dollars that they "have no reasonable prospect of recouping" in the years ahead. Plus the penalties are nowhere near as painful or long-lasting as they might assume.

But it's really not about right or wrong, moral high ground or low, but leverage. We need some. And we'd have it, if only we'd use it.

Just do it wisely. Make sure you've got legal experts who can help you use the system to your advantage. And then extract all the advantage you possibly can. The taste of their own medicine may be bitter for the banks, but that's just too fucking bad, now, isn't it?

21 November, 2009

Attention, Americans: Time to Get Economically Literate

Digby does some edimicatin'. And Cujo has a simple primer here.

I expect better results on the next quiz, damn it.

18 November, 2009

Let Them Eat Fast Food

14% of the people in this country can't get enough food, and it's no big deal to them. That says all you need to know about Cons' concern for ordinary people.I am so glad that Wall Street is on track for such huge bonuses this year. That's because they can use all that money to buy food for the 49 million Americans - 49 million Americans! Jesus! who "lacked consistent access to adequate food" by the end of the Bush administration.

49 million Americans. Shameful. Shameful!

And check this out towards the end:

“Very few of these people are hungry,” said Robert Rector, an analyst at the conservative Heritage Foundation. “When they lose jobs, they constrain the kind of food they buy. That is regrettable, but it’s a far cry from a hunger crisis.”49 million Americans have been "struggling with hunger" - as the director of the food center who sponsored the study says - and all conservatives can say is, "Hey, that's not so bad."

Jesus.

My God, that anyone takes conservatives seriously on anything simply boggles the mind. 49 million Americans can't eat well on a regular basis - not won't, but can't - and this asshole pooh-poohs the problem. (By the way, you might want to Google "Robert Rector Heritage Foundation" for a good idea of how wrong someone can be. Authoring flawed studies on immigration. Advocating worthless sex education programs. He's one more extreme-right conservative clown clone.)

This is the same mentality that leads Cons to declare that people can just go to the emergency room when they're sick, and hey, presto! everybody has health care. As long as restaurants have easily-accessible trash bins and Mickey D's has a dollar menu, they'll say the same thing about Americans' access to food.

07 November, 2009

What Does It Take to Get a Little Unemployment Extension, Here?

Why Cons pull this kind of shit when the jobless numbers are this horrible is beyond me. Are they telling us they want to lose in 2010? Is that it? Because if it is, I'm more than happy to ensure that happens.

And so are - lemme see - 200,000 unemployed Americans who lost their benefits while the Cons played their little con games.

06 November, 2009

"The Green Economy's Coming! The Green Economy's Coming!"

And that green economy's coming despite the best efforts of bleedin' buffoons to boycott it:Extensive coverage has been devoted to the fact that Lindsey Graham’s split on global warming and other issues highlights a rift in the Republican Party. While that’s true, another more important development has not been pursued: Graham’s departure from right-wing orthodoxy highlights the potential for conservative Democrats to follow in his footsteps.

Many conservative Democrats have questioned President Obama’s clean energy agenda. Now, a Republican is breaking with his party to talk sense. In a press conference yesterday with Sen. John Kerry (D-MA), the author of the Clean Energy Jobs and American Power Act, and Sen. Joe Lieberman (I-CT), Graham rebuked senators unwilling to address carbon pollution. Saying that he has “seen the effects of a warming planet,” Graham called for the United States to “lead the world rather than follow the world on carbon pollution”:

The green economy is coming. We can either follow or lead. And those countries who follow will pay a price. Those nations who lead in creating the new green economy for the world will make money.

Dunno 'bout that. It's looking pretty lively to me.A major climate change bill passed out of the Senate Environment and Public Works Committee amid a Republican boycott this morning, setting the stage for other panels to amend the legislation. The final vote was 11-1. Sen. Max Baucus (D-MT)--whose Senate Finance Committee probably have its own crack at the bill--was the lone hold out. No Republicans showed up to vote.

Baucus says he wants near-term emissions targets softened, and to prevent the Environmental Protection Agency from stepping in to regulate carbon emissions on its own, pursuant to a 2007 Supreme Court ruling.

After the vote, ranking member James Inhofe (R-OK) appeared on Fox News and, in predictable fashion, lambasted the legislation, calling the committee's actions "unprecedented." He also claimed that the bill is "dead."

Everybody got their green-collar shirts ready? It should only take until, oh, say, late 2010, early 2011, to overcome Conservadem and Con foot-dragging, tantrum-throwing, and Teabag-army-leading hysterics.

20 October, 2009

Oh, Dear, He's Gone Shrill Again

It was the best of times, it was the worst of times. O.K., maybe not literally the worst, but definitely bad. And the contrast between the immense good fortune of a few and the continuing suffering of all too many boded ill for the future.

I’m talking, of course, about the state of the banks.

[snip]

But it’s not a simple case of flourishing banks versus ailing workers: banks that are actually in the business of lending, as opposed to trading, are still in trouble. Most notably, Citigroup and Bank of America, which silenced talk of nationalization earlier this year by claiming that they had returned to profitability, are now — you guessed it — back to reporting losses.

[snip]

But there’s an even bigger problem: while the wheeler-dealer side of the financial industry, a k a trading operations, is highly profitable again, the part of banking that really matters — lending, which fuels investment and job creation — is not. Key banks remain financially weak, and their weakness is hurting the economy as a whole.

You may recall that earlier this year there was a big debate about how to get the banks lending again. Some analysts, myself included, argued that at least some major banks needed a large injection of capital from taxpayers, and that the only way to do this was to temporarily nationalize the most troubled banks. The debate faded out, however, after Citigroup and Bank of America, the banking system’s weakest links, announced surprise profits. All was well, we were told, now that the banks were profitable again.

But a funny thing happened on the way back to a sound banking system: last week both Citi and BofA announced losses in the third quarter. What happened?

Part of the answer is that those earlier profits were in part a figment of the accountants’ imaginations. More broadly, however, we’re looking at payback from the real economy. In the first phase of the crisis, Main Street was punished for Wall Street’s misdeeds; now broad economic distress, especially persistent high unemployment, is leading to big losses on mortgage loans and credit cards.

And here’s the thing: The continuing weakness of many banks is helping to perpetuate that economic distress. Banks remain reluctant to lend, and tight credit, especially for small businesses, stands in the way of the strong recovery we need.

[snip]

[W]e desperately need to pass effective financial reform. For if we don’t, bankers will soon be taking even bigger risks than they did in the run-up to this crisis. After all, the lesson from the last few months has been very clear: When bankers gamble with other people’s money, it’s heads they win, tails the rest of us lose.

So, Mr. President, how's about listening to a fellow Nobel laureate instead of the stable of assclowns currently advising you on economic policy? Before, y'know, it's too late.

08 October, 2009

Once Again, Bush is to Blame

Via Raw Story, this very enlightening news that the Bush administration blocked efforts to enforce laws against predatory lending. We are so shocked:

Federal regulators in the Bush administration blocked attempts by state governments to prevent predatory lending practices that resulted in the financial crisis now stalking the American economy, a new study from the University of North Carolina says.

In 2004, the Office of the Currency Comptroller, an obscure regulatory agency tasked with ensuring the fiscal soundness of America's banks, invoked an 1863 law to give itself the power to override state laws against predatory lending. The OCC told states they could not enforce predatory-lending laws, and all banks would be subject only to less-strict federal laws.

Now, a research paper (PDF) from UNC-Chapel Hill's Center for Community Capital shows that those anti-predatory lending laws had actually worked. States that had stricter regulations on issuing mortgages were found to have fewer foreclosures.

[snip]

The study may be the first scientific evidence to back up claims made by many critics that the Bush administration and earlier administrations allowed last year's financial crisis to happen by not enforcing common-sense regulations on lenders.

Here endeth the lesson in why Cons should never, ever be allowed to get their grubby hands on the reins of power ever again.

11 September, 2009

Don't Say W Never Gave Us Anything

We interrupt yesterday, today and tomorrow's media soccer scrum ("Does Ellen DeGeneres Think Michael Vick Should Agree With Joe Wilson About Health Care?") to bring you the consequences of a Gilded Age economy:My dear fellow Americans: if you ever vote a Con into the Oval Office again, you'd best be prepared for the consequences. You'd better hope there's still room under the overpass for you when you've pissed your prosperity away.The U.S. Census Bureau has just announced that the poverty rate for 2008 was 13.2%. This means the number of people in poverty has increased by about 2.5 million, to 39.8 million. To give you some perspective, 2.5 million is more than the number of people who live in Detroit and San Francisco combined.The Census data is just devastating, particularly when you take into account that the numbers come before the job loss in the first 8 months of this year. In addition to the uptick in the poverty rate, real median household income fell 3.6%, the biggest drop in 40 years. The richest tenth of one percent saw their incomes rise by 35% over the last 10 years while median incomes stayed flat. And the number of Americans lacking health insurance increased by about 700,000 to at least 46.3 million, which does not account for the under-insured. In fact, if it wasn't for government programs, this number would be far worse.

07 September, 2009

Banking on Death

Meanwhile, everyone is very excited about the next big scheme:Cue the right-wing outrage in 3...2... - oh, wait, it's the Free Market, so it's totally okay. Even if our premiums soar because some Wall Street Wizurds think they're impoverished if their bonuses dip below several million a year, well, that's just the glory of capitalism right there!After the mortgage business imploded last year, Wall Street investment banks began searching for another big idea to make money. They think they may have found one.

The bankers plan to buy “life settlements,” life insurance policies that ill and elderly people sell for cash — $400,000 for a $1 million policy, say, depending on the life expectancy of the insured person. Then they plan to “securitize” these policies, in Wall Street jargon, by packaging hundreds or thousands together into bonds. They will then resell those bonds to investors, like big pension funds, who will receive the payouts when people with the insurance die.

The earlier the policyholder dies, the bigger the return — though if people live longer than expected, investors could get poor returns or even lose money.

Either way, Wall Street would profit by pocketing sizable fees for creating the bonds, reselling them and subsequently trading them. But some who have studied life settlements warn that insurers might have to raise premiums in the short term if they end up having to pay out more death claims than they had anticipated.

As you can see, the Wizurds have learned nothing about risk, seeing as how taxpayers will make sure their stupidity and greed don't end up destroying the financial industry.

Better prepare yourselves for another massive bailout when this shit hits the fan.

05 September, 2009

Another Greatest Hit from the Party of Bad Ideas

As frustrating as it is to see the economy shed another 216,000 jobs in August, the trend is at least going in the right direction. August's numbers were bad, but they were slightly better than expected, and more importantly, they constituted the best month for the U.S. job market in the last 12 months.Why anyone thinks these fucktards are capable of governing is beyond me.White House press secretary Robert Gibbs said the improvements are evidence of successful administration efforts. House Speaker Nancy Pelosi added, "We have a long way to go; but fortunately, President Obama and congressional Democrats acted decisively earlier this year, and the results are beginning to show." The chief economist for the U.S. Chamber of Commerce -- not exactly Liberal Central -- said the stimulus has, in fact, helped turn the economy around.

Then, there's the other side. Republicans responded to this morning's jobs report exactly as they have every month since February -- by expressing outrage that President Obama, who inherited the worst recession in generations, has not already fixed the economy. Republican National Committee Chairman Michael Steele said the August numbers are proof "this administration is ignoring reality."

The irony is rich. In fact, Pat Garofalo has a good item about reality today.

Of course, the new numbers have ignited the monthly ritual of conservatives labeling the stimulus a failure. Rep. Eric Cantor (R-VA), after calling this week for completely canceling the stimulus, doubled down today, saying that the jobless numbers mean we should use stimulus funds to "pay down our debt."

But as Bloomberg News pointed out, "rising joblessness underscores Treasury Secretary Timothy Geithner's judgment this week that it's 'too early' to start exiting from the unprecedented stimulus measures aimed at stabilizing the economy."

[snip]

The blazing fire the president found burning when he was sworn in hasn't been extinguished. And the first Friday of every month offers his detractors another chance to ask why the president keeps throwing water at the problem, using the smoldering ashes as evidence of why the spigots should be turned off immediately.

And as for all their screaming about paying down the debt, let's not forget how happy they were adding to the deficit in the first place (h/t Paco).

Tell you what. Since they're soooo concerned about the national debt, and so very responsible for a gargantuan proportion of it, why don't they use their campaign coffers to pay it down?

15 August, 2009

The Rich Got Richer

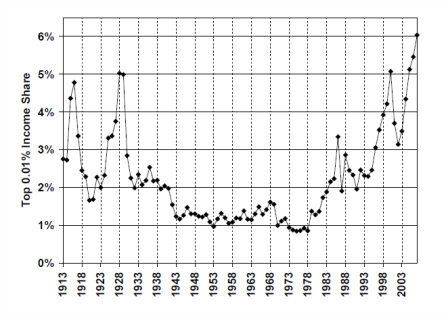

That's right. The gap between rich and poor in this country is larger than it was on the eve of the Great Depression.With everything else going on, the latest inequality numbers from Emmanuel Saez, now updated to 2007, didn’t get much attention. But they’re truly amazing:

The top 10% earn nearly 50% of the wages. I do believe they can afford to sacrifice a percent or two for the greater good of the country.

We won't discuss right at this moment how those few came to suck up so much of the nation's earnings. But as for the myth that good, honest, hard work got them to the top, I have just two words: Goldman Sachs.

01 August, 2009

The Stimulus is Working, Bitches

When the second quarter GDP numbers were released this morning, the data showed the economy faring slightly better after six months of deep and painful contraction. It wasn't consumer spending that led to progress, however, but rather government spending that "helped economic activity in the spring."Now, that in and of itself, is probably uncomfortable news for conservative Republicans, who've spent the better part of the year, if not the better part of their adult lives, arguing that government spending is incapable of helping economic activity. Indeed, let's recall that earlier this year, at the height of the economic crisis, the congressional GOP insisted that a five-year spending freeze was the responsible course of action.

But more to the point, these conservatives failed, and Democrats passed a stimulus package. The Economic Policy Institute's Josh Bivens reviews the numbers from the second quarter and concludes that the recovery efforts made a real difference. (via Kevin Drum)

The marked improvement in this quarter relative to last is largely due to the American Recovery and Reinvestment Act (ARRA).... Despite the overall contraction, the fingerprints of the American Recovery and Reinvestment Act could be seen in some aspect of today's report. Federal government spending grew at an 11% rate in the quarter, adding roughly 0.8% to overall GDP. State and local government spending grew at a 2.4% annual rate, the fastest growth since the middle of 2007. It is clear that the large amount of state aid contained in the ARRA made this growth possible.

Furthermore, real (inflation-adjusted) disposable personal income rose by 3.2% in the quarter, after rising by only 1% in the previous quarter. A large contribution to this increase was made by the Making Work Pay tax credit passed in conjunction with the ARRA, as this was the first full quarter that the credit was in effect. [...]

The consensus of macroeconomic forecasters is that ARRA contributed roughly 3% to annualized growth rates in the second quarter. This means that absent its effects, economic performance would have resembled that of the previous three quarters.

Kevin added, "The argument that the stimulus bill has 'failed' because times are still tough has always been dimwitted. There was never any chance that it was going to miraculously end the recession, only that it might make it a little shallower than it otherwise would have been. So far, it appears to have done exactly that."

One of these days, I shall have to have a special newspaper printed with all the hard data that contradicts Cons' claims about the stimulus, health care, and just about everything else they yammer about. It would be such a delight to roll that newspaper up and apply it to certain backsides.

09 July, 2009

The Regulators Are Coming

You know, I often wish Obama would do a better job - his Bush Mark II impression on various detainee issues and sundry other national security issues being the prime examples - but when I get news like this, I'm reminded just how much he doesn't resemble Bush.

Once we get the man disabused of certain notions, I think he's going to turn out to be a delight. Well, to folks who don't make their livings fucking over the financial markets, that is. This is change I can believe in.

14 April, 2009

Cons Want to Ensure You Can't Afford College

The corporate lobbyists continue to line up to obstruct President Obama's budget reforms. An excellent example is the proposed rollback of the privatization of the student loan industry, which has caused lots of consternation among... the private student loan industry (which, incidentally, got a bailout last year). They think direct government lending of student loans, which would save $94 billion dollars over a decade, would just be a terrible outcome for, well, them, and they're leading a fight based on, get this, the fact that Pell grants would be mandatory and not subject to the whims of appropriators. "Make grants for higher education more uncertain!" certainly sounds like the stuff of popular outcry.Oh, indeed.

Between this and my post below, a question is forming: why are regular ol' people stupid enough to fall for this Con "party of fiscal responsibility" bullshit when it's clear that all the Cons do is rob from the taxpayers to enrich their corporate buddies?

12 April, 2009

Poetic Justice

Heh.Now we find out that Congresscritter Joe Barton (R-Texas) thought that the stock market was better than a bank when it came to being a place to park one's campaign cash. That thought wound up costing him $700,000 last year.

What was that again about Republicans being good with money?

09 April, 2009

Cramer Never Learns

When I heard Jim Cramer "call" a new bull market the other days I actually laughed out loud. Not because I have any knowledge about that one way or the other, but because he's been so spectacularly wrong so often that I find it amusing that he's got the chutzpah to proclaim anything more controversial than that he expects the sun to come up tomorrow.

But Nouriel Roubini took him downtown:Just weeks after "The Daily Show" host Jon Stewart took Cramer to task for trying to turn finance reporting into a "game," famous bear economist Nouriel Roubini criticized Cramer on Tuesday for predicting bull markets."Cramer is a buffoon," said Roubini, a New York University economics professor often called Dr. Doom. "He was one of those who called six times in a row for this bear market rally to be a bull market rally and he got it wrong. And after all this mess and Jon Stewart he should just shut up because he has no shame."

[snip]Roubini said in 2006 that the worst recession in four decades was on its way. He has attracted attention for his gloomy — and accurate — predictions of the U.S. financial market meltdown.

Roubini said the latest surge is just another bear market rally following the pattern of other rallies after the government intervened. He expects the market will test the previous low because of worse than expected macroeconomic news, disappointing earnings and because banks will fail after the stress tests come out.

"Once people get the reality check than it's going to get ugly again," Roubini said.

Roubini said Cramer should keep quiet.

"He's not a credible analyst. Every time it was a bear market rally he said it was the beginning of a bull and he got it wrong," Roubini said in an interview with The Associated Press.

Roubini did an admirable job wielding the Smack-o-Matic, there. I wonder if there's any possibility he and Jon can tag-team Cramer? That would be a show to remember...